Most of us grew up with the thought, "Work hard, earn more, and you’ll be set," but that's only half of the story. The reality is, people are pulling 12-hour days, yet they are still stressed about money at the end of every month. On the flip side, regular people who aren't earning lakhs but sleep peacefully because their money is quietly working harder than they do.

The big difference? The rich (or those becoming rich) don't just earn money; they make it work for them. Wealth isn't about how much comes in. It's about structure, discipline, and giving time its magic through compounding.

If you're tired of living paycheck to paycheck and want a system that actually lasts through job changes, market crashes, inflation, or life surprises. This guide is for you.

No fancy jargon, no get-rich-quick nonsense. Just a simple, repeatable framework everyone wishes that someone had handed to them 10 years ago.

Why Personal Finance Matters More Than Ever

Before we jump into the steps, understand this: personal finance isn't about being greedy or becoming a millionaire overnight. It's about freedom.

Freedom from debt stress

Freedom to say no to a toxic job

Freedom to spend time with family without worrying about bills

Freedom to take calculated risks in life

In today's world, with rising costs, uncertain jobs, and longer lifespans, if you don't build your own financial safety net, no one else will. That's the real value. It's future-proofing your life.

The Core Mindset Shift

Stop chasing higher income alone. Focus first on controlling what you already have.

Three golden rules to live by:

Control cash flow before chasing big returns

Build a monthly system you can repeat forever

Invest with clear intention, never emotion

Got it? Let's break it down into a dead-simple 3-step framework.

Step 1: Start With Your Primary Income - The Engine

Your salary (or business income) is the foundation. Everything else crumbles if this leaks.

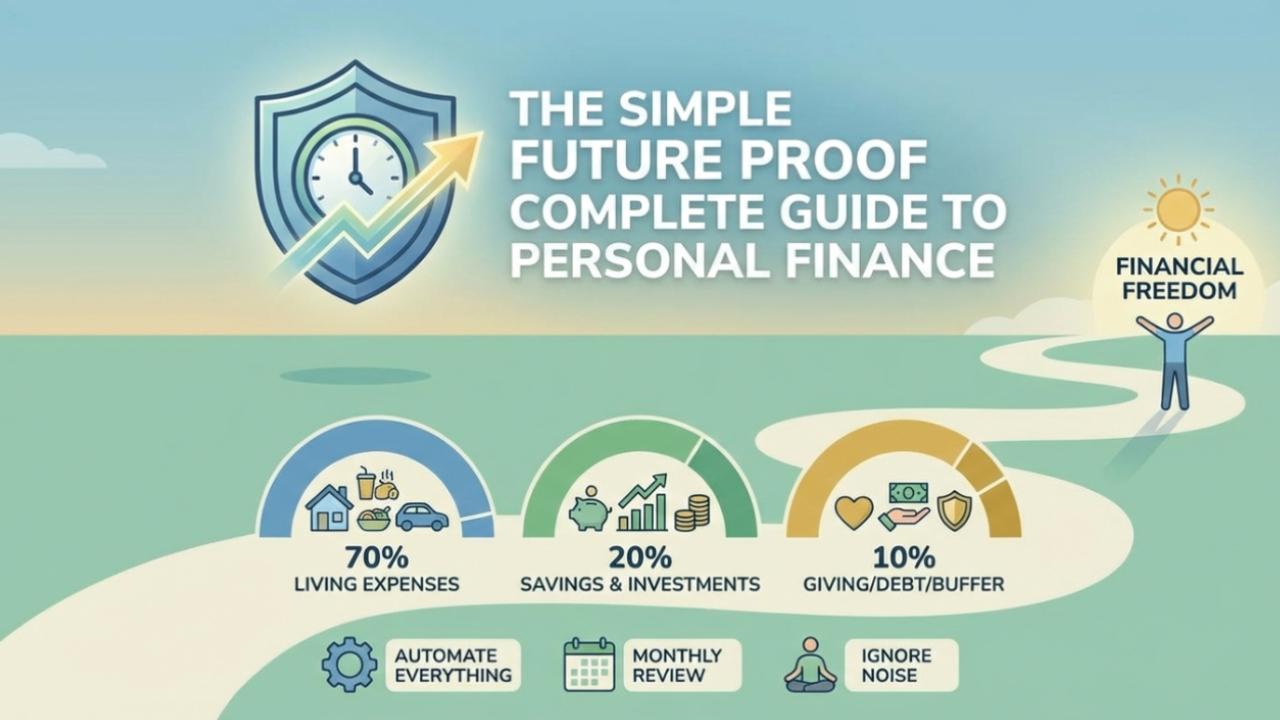

Use this easy split; adjust slightly based on your city and family size, but try to stick close:

70% Living Expenses: This covers your actual life. Don't lie to yourself here.

20% Savings & Investments: This builds your future. Non-negotiable.

10% Giving/Debt Payoff/Buffer: Charity, extra debt reduction, or fun/flex money.

Why 70-20-10?

It forces stability first.

Most people do 90% living + 10% saving (if lucky), then wonder why wealth never grows. Flip the priority: pay your future self before anyone else.

Pro tip: Track for 3 months exactly where the 70% goes. You'll be shocked at the leaks: subscriptions, eating out, impulse buys. Fix those first.

Step 2: Give Every Rupee a Clear Job (No More Leaks!)

Vague buckets = money disappears. Clarity = control.

Break the 70% Living Expenses like this:

Housing + utilities (rent/EMI, electricity, water, internet)

Transportation (fuel, public transport, vehicle maintenance)

Food & groceries + essentials

Insurance (health + term life - don't skip this!)

Healthcare / medicines

Small lifestyle (movies, outings, hobbies)

Once that’s locked, the 20% savings & investments get purpose too:

Short-term safety net (next 1–5 years):

3 to 6 months emergency fund in liquid FD or savings

Sinking funds for Diwali, vacation, phone replacement, etc.

Long-term growth (10+ years):

Retirement (EPF + NPS or PPF)

Equity mutual funds / ETFs / direct stocks (via SIPs)

Real estate (if it fits your plan - but don't rush)

The goal: security first, then steady compounding. When your basics are covered, you stop panicking during market dips.

Step 3: Invest With Structure - Not Hope or Hype

Investing isn't gambling. It's a boring, repetitive process that wins over decades.

Allocate based on risk, not on what's trending on social media:

Low risk (capital preservation): FD, debt funds, PPF, and bonds for emergency fund and near-term goals.

Moderate risk (steady compounding): Large-cap/flexi-cap mutual funds and index ETFs (60 to 70% of long-term portfolio for most people).

High risk (growth kicker): Small/mid-cap, individual stocks, and crypto (strict 10–20% max, with clear exit rules).

Rule of thumb: Never invest money you'll need in the next 5 years in equities. And never go all-in on one stock or sector because "it feels hot."

We have discussed the Step 3 in depth with our series on Value Investment and Mindset You can check out this series and know more about value investing.

Bonus Habits That Make It Future-Proof

A. Automate everything: Salary credit and immediate auto-transfer to savings/investments on day 1. You won’t miss what you don’t see.

B. Monthly review (just 30 mins): Check inflows/outflows, adjust if needed. No drama, just calm tweaks.

C. Ignore noise: Markets will crash, influencers will scream "buy now!" Stay boring. Wealth loves boring consistency.

Final Thought From Finance Gurudeva

Wealth isn't built by chasing the next hot tip or waiting for a salary jump. It's built by repeating small, unsexy decisions month after month.

Structure first.

Discipline second.

Financial freedom is third.

Start today even if it's just a ₹500 SIP or cutting one unnecessary subscription. Small steps compound faster than you think.

What’s one change you’re making this month? Drop it in the comments. Let's keep each other accountable. If this helped, share it with one friend who needs it. And follow for more no-BS finance content.

Stay wealthy, stay wise.

#PersonalFinance #FinancialFreedom #MoneyMindset #InvestSmart #FutureProof #investment #finance #financial #money #increaseincome #income #passive